In order to ensure the implementation of the “zero tariff” policy for means of transport and yachts, the qualification declaration function for enterprises to import “zero-tariff” means of transport and yachts was officially launched in the China (Hainan) International Trade “Single Window” on January 12, 2021.

According to the “Zero-Tariff” Policy for Means of Transport and Yachts in the Hainan Free Trade Port (for Trial Implementation), enterprises can declare through the China (Hainan) International Trade “Single Window”, and the relative supervisory departments shall review the enterprises in accordance with the policy provisions and responsibilities. After passing the review, these enterprises will be automatically placed on the list of the qualified enterprises that are eligible for preferential policies. Haikou Customs will go through import clearance procedures according to the list.

website:http://www.singlewindow.hn.cn

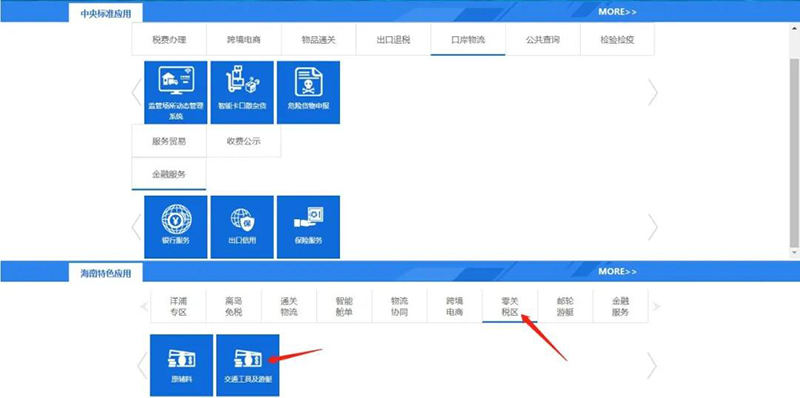

After enterprises log into the China (Hainan) International Trade “Single Window”, they can find the entrance for qualification declaration for “zero tariff” in Zero Tariff Zone of Hainan Characteristic Application (as shown in Figure 1).

Figure 1: Enterprise Qualification Declaration Entrance for “Zero Tariff” of Imported Means of Transport and Yachts

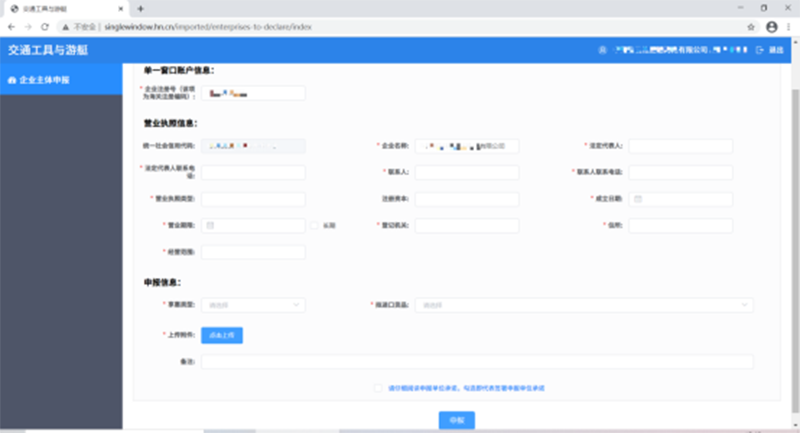

Enterprises can submit application for “zero tariff” qualification for imported means of transport and yachts to Hainan Provincial Department of Transportation, Haikou Customs and other related supervisory units through this function module (as shown in Figure 2), and the review results will be returned to enterprises after approval. After getting the approval, the enterprise can import “zero tariff” means of transport and yachts.

Figure 2: Application Interface for the “Zero Tariff” Qualification of Enterprises to Import Means of Transport and Yachts

Besides, the Management Platform for Zero Tariff Equipment, Means of Transport and Yachts was launched in the processing trade module of Central Standard Application of China (Hainan) International Trade “Single Window” (as shown in Figure 3), through which enterprises can declare account management record, transfer registration, loan mortgage application, application for early deregulation and application for transfer under special circumstances. Through this function, the customs can realize the “one account for one enterprise” management of “zero tariff” enterprises in the island.

Figure 3: Management Platform for “Zero Tariff” Equipment, Means of Transport and Yachts

For the questions of general concern, the Implementation of the “Zero-Tariff” Policy for Means of Transport and Yachts in the Hainan Free Trade Port (for Trial Implementation) is interpreted as follows:

Q:What kinds of enterprises are eligible for the policy?

A:1.Registered in Hainan Free Trade Port;

2.With independent legal personality;

3.Enterprises engaged in transportation and tourism (aviation enterprises must take Hainan Free Trade Port as the main operation base).

The above three requirements must be met simultaneously.

Q:What kinds of imported means of transport and yachts are eligible for “zero tariff” ?

A:The means of transport and yachts eligible for the “zero tariff” policy are subject to the positive list management.

1. For the positive list of “zero tariff” means of transport and yachts, please refer to the annex of No. 54 [2020] of the Ministry of Finance (The List of “Zero Tariff” Means of Transport and Yachts for Hainan Free Trade Port). The list includes 100 items with 8-digit tax number, including passenger cars, trucks, trailers, aircraft, ships, yachts, etc.

Note: The commodity coverage with the No.72 tax number of “88052900” does not include components and parts.

2. The positive list shall be dynamically adjusted by the Ministry of Finance, the General Administration of Customs and the State Administration of Taxation together with relevant departments according to the actual needs and regulatory conditions of Hainan.

Q:What are the requirements for import declaration?

A:1. The management mode of “one account for one enterprise” is implemented to “zero tariff” means of transport and yachts. Customs registration shall be carried out during the first import declaration, and the enterprise account information shall be completed.

After being approved and included in the list of enterprises eligible for preferential policy by the competent departments, the enterprises shall register in the customs in accordance with the Provisions of the Customs of the People’s Republic of China on the Administration of Registration of Customs Declaration Entities before declaring the import of “zero tariff” means of transport and yachts for the first time, and complete enterprise account information in the “Hainan Management Platform for Zero Tariff Equipment, Means of Transport and Yachts” of International Trade “Single Window” .

2.the import of “zero tariff” means of transport and yachts must be declared to the customs through the International Trade “Single Window”.

Q:Matters needing attention after import

A:1.Accepting customs supervision according to the law

a.“Zero tariff” means of transport and yachts are limited to enterprises’ own use and subject to customs supervision according to the law.

The supervision period is: 8 years for ships (including yachts) and aircraft; 6 years for vehicles.

b.Unless otherwise stipulated by the General Administration of Customs, within the period of customs supervision, enterprises shall keep and use imported “zero tariff” means of transport and yachts in accordance with the policy and customs provisions.

2.Implementation of annual report management

The enterprises shall submit the report on the use of “zero tariff” means of transport and yachts of the previous year to the local customs before June 30 (included) of each year.

3.Operating according to policy

a.Aircraft and ships shall be used in the operation of domestic and foreign routes starting from or stopping at Hainan Free Trade Port.

b.The yachts shall be operated within Hainan Province.

c.Vehicles can be engaged in passenger and freight transportation between the mainland and Hainan Island, as long as at least one end of the destination shall be in Hainan Free Trade Port, and the total duration of stay in the mainland does not exceed 120 days per year. However, “point-to-point” and “immediate return” passenger cars and trucks from Hainan Free Trade Port to the mainland are not subject to the limitation of number of days.

In case of violation of the above provisions, import duties shall be paid in accordance with the relevant provisions.

The dutiable value for overdue tax is based on the dutiable value of “zero tariff” means of transport and yachts when they are imported, which shall be adjusted proportionally according to time of paying the tax and the supervision period.

4.Three situations in need of attention

Within the period of customs supervision, the transfer of “zero tariff” means of transport and yachts, mortgage of loans, and repatriation by enterprises shall be examined and approved by the customs.

a.Transfer

If it is necessary to transfer due to bankruptcy and other reasons, an application shall be submitted to the competent customs through “Hainan Management Platform for Zero Tariff Equipment, Means of Transport and Yachts” before the transfer. Among them, those who transfer these goods to the subjects who are not eligible for “zero tariff” policy shall make up the import tax according to the regulations.

b.Loan mortgage

If an enterprise needs to mortgage the “zero tariff” means of transport and yachts to domestic banks or non-bank financial institutions, it shall submit an application to the competent customs through the “Hainan Management Platform for Zero Tariff Equipment, Means of Transport and Yachts” in advance, and provide a tax guarantee approved by the customs. Enterprises shall not use “zero tariff” means of transport and yachts to mortgage loans to citizens, legal persons or other unincorporated organizations other than banks or non-bank financial institutions.

c.Repatriation or export

If an enterprise needs to repatriate or export “zero tariff” means of transport and yachts, it shall submit an application to the competent customs through “Hainan Management Platform for Zero Tariff Equipment, Means of Transport and Yachts” and go through relevant procedures.

5.Violation Handling

If an enterprise violates the relevant provisions, which constitutes smuggling or violation of customs supervision regulations, the customs shall deal with it in accordance with the relevant provisions of the Customs Law of the People’s Republic of China and the Regulation of the People’s Republic of China on the Implementation of Customs Administrative Punishment; If a crime is constituted, criminal responsibility shall be investigated according to law.

What kind of dividends can “zero tariff” vehicle and yacht policy bring to enterprises?

For example:

An airline registered in Hainan Free Trade Port and with independent legal personality (Engaged in transportation industry. Its main operation base is Hainan Free Trade Port.) needs to import a large airliner (Within the scope of annex list. HS Code: 88024020. According to Customs Import and Export Tariff of PRC [2021], the comprehensive import tax rate is about 14.13%.) with empty weight of more than 45 tons for its own use. The dutiable value is assumed as 1 billion yuan.

Before the implementation of preferential policy

The import tax to be paid by the enterprise is as follows:

RMB 1 billion × 14.13%= RMB 141 million

After the implementation of preferential policy

The import tax to be paid by the enterprise is as follows:

RMB 0 yuan

Ship

A transportation enterprise with independent legal personality, which is registered in Hainan Free Trade Port, needs to import a cargo ship (Within the scope of the annex list. HS Code: 89019041. According to Customs Import and Export Tariff of PRC [2021], the comprehensive import tax rate is about 23.17%.) for its own use. The dutiable value is assumed as RMB 100 million.

Before the implementation of preferential policy

The import tax to be paid by the enterprise is as follows:

RMB 100 million x 23.17%= RMB 23.17 million

After the implementation of preferential policy

The import tax to be paid by the enterprise is as follows:

RMB 0 yuan

Hainan Marine Trade Exchange Service Center:

Hainan Marine Trade Exchange Service Center: Sanya International Yachting Center:

Sanya International Yachting Center: Phone:+86 898 88222388

Phone:+86 898 88222388 Email:hnmteshr@163.com

Email:hnmteshr@163.com